Business Intelligence Tools That Improve Underwriting: A Deep Dive

Underwriting, the process of assessing risk and determining the terms of insurance policies, is a complex and data-intensive undertaking. In today’s rapidly evolving financial landscape, insurance companies are constantly seeking ways to streamline operations, improve accuracy, and make more informed decisions. Enter business intelligence (BI) tools, powerful software solutions that are transforming the underwriting process. These tools provide the capabilities to analyze vast amounts of data, identify trends, and ultimately, enhance the efficiency and profitability of insurance operations. This article explores how business intelligence tools are revolutionizing underwriting.

The insurance industry is built on data. From customer demographics and financial history to health records and property values, underwriters must consider a wide range of factors to accurately assess risk. Traditionally, this process involved manual data entry, spreadsheet analysis, and reliance on human intuition. However, this approach is often time-consuming, prone to errors, and limits the ability to identify subtle patterns and insights. Business intelligence tools address these shortcomings by automating data collection, providing sophisticated analytical capabilities, and enabling underwriters to make data-driven decisions.

The Core Benefits of BI Tools in Underwriting

The implementation of business intelligence tools offers a multitude of benefits for insurance companies. These improvements extend across various aspects of the underwriting process, leading to greater efficiency, accuracy, and profitability. Here are some key advantages:

- Enhanced Data Analysis: BI tools can ingest and analyze massive datasets from various sources, including customer applications, claims history, market data, and external risk assessments. This enables underwriters to gain a comprehensive view of each applicant and assess risk more accurately.

- Improved Risk Assessment: By identifying patterns and correlations within the data, business intelligence tools help underwriters to better understand the factors that contribute to risk. This leads to more precise risk assessments and more competitive pricing.

- Automation and Efficiency: BI tools automate many of the manual tasks involved in underwriting, such as data entry, report generation, and compliance checks. This frees up underwriters to focus on more complex and strategic tasks.

- Fraud Detection: Advanced analytics capabilities allow BI tools to detect fraudulent activity and identify suspicious claims patterns. This helps insurance companies to reduce losses and protect their bottom line.

- Increased Profitability: By improving risk assessment, reducing operational costs, and detecting fraud, business intelligence tools ultimately contribute to increased profitability for insurance companies.

Key Features of Effective Business Intelligence Tools

Not all business intelligence tools are created equal. To maximize the benefits of these solutions, insurance companies should choose tools that offer a comprehensive suite of features tailored to the specific needs of underwriting. Here are some essential features to consider:

- Data Integration: The ability to seamlessly integrate data from various sources is crucial. The tool should be able to connect to different databases, data warehouses, and external data providers.

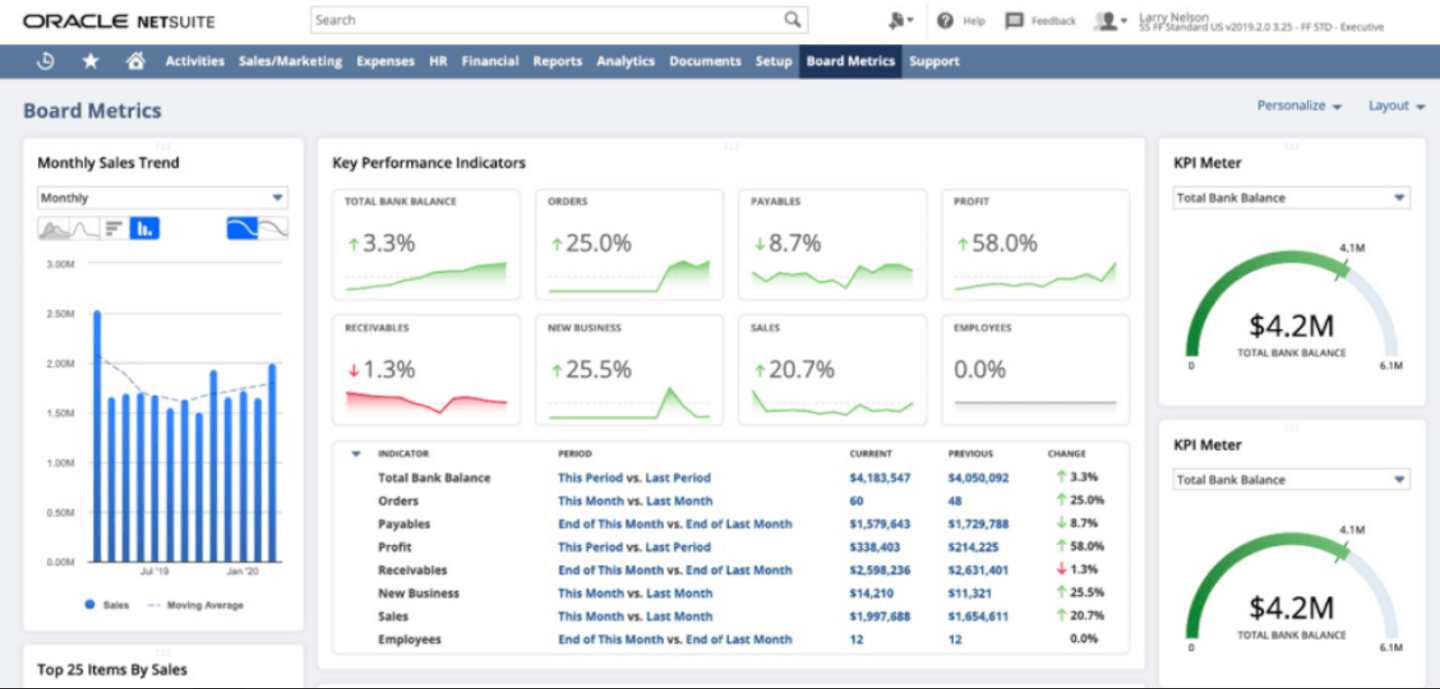

- Data Visualization: Powerful data visualization capabilities are essential for presenting complex data in an easy-to-understand format. This includes charts, graphs, dashboards, and interactive reports.

- Advanced Analytics: The tool should offer advanced analytical capabilities, such as predictive modeling, machine learning, and statistical analysis. This enables underwriters to identify trends, predict future outcomes, and make data-driven decisions.

- Reporting and Dashboards: Customizable dashboards and reports provide underwriters with real-time insights into key performance indicators (KPIs) and allow them to monitor the underwriting process effectively.

- Workflow Automation: Features that automate routine tasks, such as data validation and report generation, can significantly improve efficiency and reduce manual effort.

- User-Friendly Interface: The tool should have an intuitive and easy-to-use interface that allows underwriters to quickly access and analyze data without extensive training.

Specific BI Tools for Underwriting

Several business intelligence tools are well-suited for use in the underwriting process. Each tool offers a unique set of features and capabilities. The best choice depends on the specific needs and requirements of the insurance company. Some popular options include:

- Tableau: Tableau is a leading data visualization and business intelligence tool that is known for its user-friendly interface and powerful analytical capabilities. It allows underwriters to easily create interactive dashboards and reports.

- Microsoft Power BI: Power BI is a cost-effective business intelligence tool that offers a wide range of features, including data integration, data visualization, and advanced analytics. It is a popular choice for small and medium-sized insurance companies.

- Qlik Sense: Qlik Sense is another popular business intelligence tool that is known for its associative data modeling capabilities. This allows underwriters to explore data in a more intuitive and flexible way.

- SAS Business Intelligence: SAS offers a comprehensive suite of business intelligence tools that are designed for enterprise-level insurance companies. SAS provides advanced analytics, data mining, and predictive modeling capabilities.

- IBM Cognos Analytics: IBM Cognos Analytics is a robust business intelligence tool that provides a wide range of features, including data integration, data visualization, and reporting capabilities.

Real-World Applications and Case Studies

The impact of business intelligence tools on underwriting is not just theoretical. Many insurance companies have successfully implemented these tools and experienced significant improvements in their operations. Here are a few examples:

- Improved Risk Selection: By analyzing customer data and identifying high-risk profiles, one insurance company was able to reduce its claims payout ratio by 15% within a year.

- Fraud Detection: Another company used business intelligence tools to identify and prevent fraudulent claims, saving the company millions of dollars annually.

- Faster Processing Times: By automating manual tasks, one insurance company was able to reduce its underwriting processing times by 30%.

- Enhanced Customer Experience: By providing underwriters with more accurate and timely information, companies can offer better customer service and more personalized policies.

Challenges and Considerations

While business intelligence tools offer significant benefits, there are also some challenges and considerations that insurance companies should be aware of before implementation:

- Data Quality: The accuracy and reliability of the data are crucial for the effectiveness of the tool. Insurance companies need to ensure that their data is clean, consistent, and up-to-date.

- Integration Complexity: Integrating business intelligence tools with existing systems can be complex and time-consuming. Companies need to carefully plan the integration process and ensure that the tool is compatible with their existing infrastructure.

- User Training: Underwriters need to be properly trained on how to use the tool effectively. Companies should invest in training programs to ensure that underwriters are able to leverage the tool’s features and capabilities.

- Cost: The cost of implementing and maintaining business intelligence tools can be significant. Companies need to carefully evaluate the cost of the tool and ensure that it aligns with their budget.

- Data Security and Privacy: Insurance companies handle sensitive customer data. It is essential to ensure that the business intelligence tool has robust security features and complies with all relevant data privacy regulations.

The Future of Business Intelligence in Underwriting

The future of underwriting is inextricably linked to the advancements in business intelligence tools. As technology continues to evolve, we can expect to see even more sophisticated tools that offer enhanced capabilities. Some key trends to watch include:

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML will play an increasingly important role in underwriting, enabling companies to automate more tasks, predict risk more accurately, and personalize policies.

- Cloud-Based Solutions: Cloud-based business intelligence tools are becoming increasingly popular, offering greater flexibility, scalability, and cost-effectiveness.

- Big Data Analytics: As the volume of data continues to grow, insurance companies will need to invest in tools that can handle big data analytics.

- Integration with External Data Sources: The ability to integrate with external data sources, such as social media and IoT devices, will become increasingly important for assessing risk.

In conclusion, business intelligence tools are transforming the underwriting process, enabling insurance companies to make more informed decisions, improve efficiency, and ultimately, increase profitability. By embracing these tools, insurance companies can gain a competitive advantage and position themselves for success in the future.

[See also: The Role of Data Analytics in Insurance, Predictive Modeling in Underwriting, How AI is Changing the Insurance Industry]