Why Risk Managers Need These BI Tools: Navigating Uncertainty in the Modern Era

In today’s volatile business landscape, risk managers face an unprecedented challenge: anticipating and mitigating threats in an environment of constant change. From geopolitical instability to economic fluctuations and rapidly evolving technological advancements, the sources of risk are numerous and complex. To successfully navigate this challenging terrain, risk managers are increasingly turning to sophisticated tools. Business intelligence (BI) tools, in particular, are emerging as essential components of a robust risk management strategy. This article will explore why risk managers need these BI tools and how they can leverage them to make informed decisions, proactively identify potential threats, and ultimately, protect their organizations.

The Evolving Role of the Risk Manager

The traditional role of a risk manager has evolved significantly. Historically, the focus was often on reactive measures, addressing issues as they arose. Today, the emphasis is on proactive risk identification and mitigation. This shift demands a deeper understanding of the business, the industry, and the external environment. Risk managers must now analyze vast amounts of data, identify patterns, and predict future risks. This proactive approach is critical for organizational resilience and sustainable success. The modern risk manager is a strategic advisor, a data analyst, and a forward-thinking strategist.

The Power of Data in Risk Management

Data is the lifeblood of effective risk management. The more data risk managers have, the better equipped they are to understand and predict potential threats. However, raw data is often overwhelming and difficult to interpret. This is where BI tools come into play. These tools transform raw data into actionable insights. They provide risk managers with the ability to visualize data, identify trends, and make data-driven decisions. BI tools enable a more holistic view of risk, allowing for a more comprehensive and effective approach to risk management. Without these tools, risk managers are essentially navigating in the dark.

Key BI Tools for Risk Managers

Several types of BI tools are particularly valuable for risk managers. Each offers unique capabilities that contribute to a more comprehensive risk management strategy:

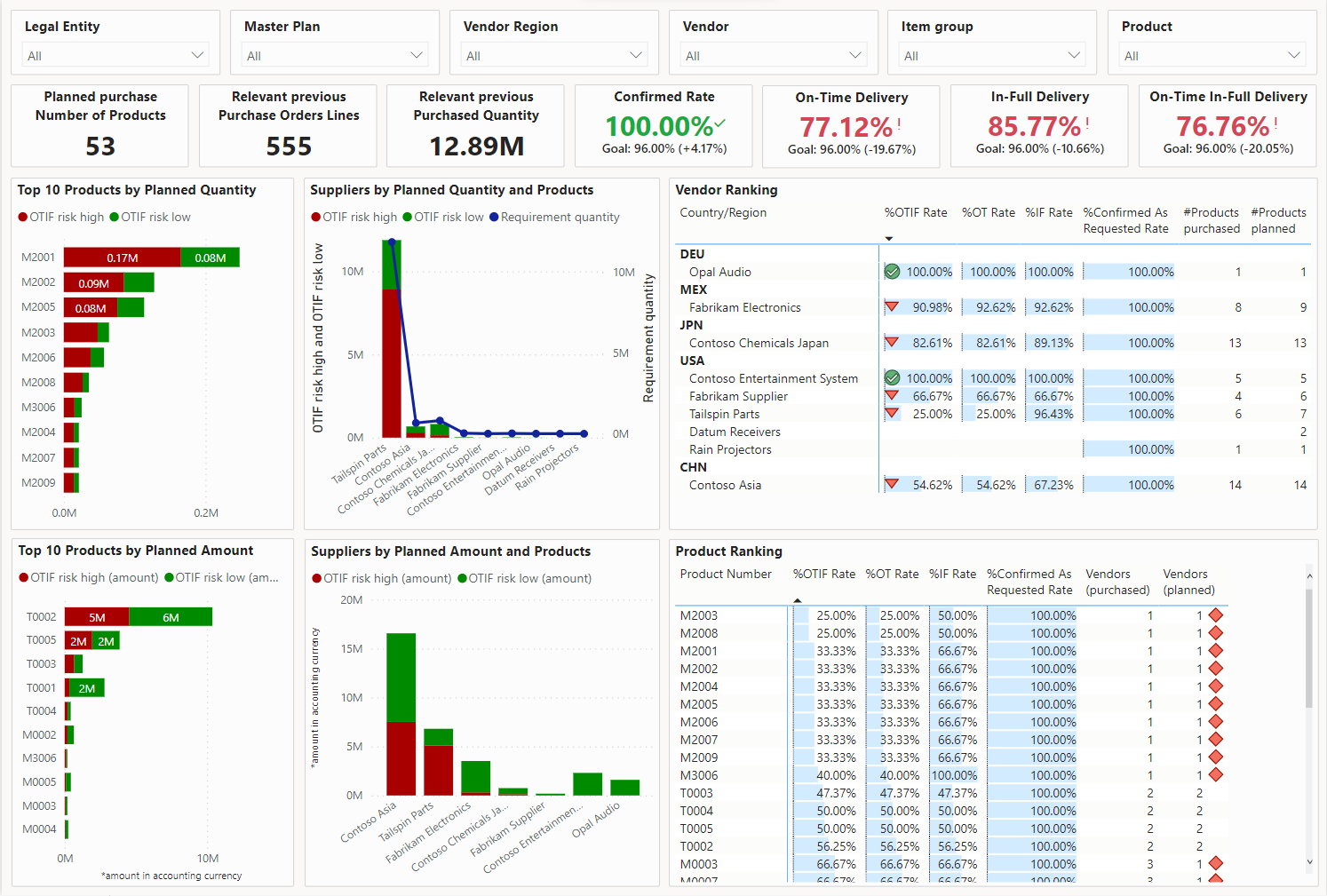

- Data Visualization Tools: These tools, such as Tableau and Power BI, allow risk managers to create interactive dashboards and reports. These visualizations make it easier to identify trends, anomalies, and potential risks. They can quickly communicate complex information to stakeholders.

- Predictive Analytics Tools: Tools like Python with libraries like Scikit-learn or specialized platforms offer predictive modeling capabilities. Risk managers can use these tools to forecast future risks, assess the likelihood of events, and develop proactive mitigation strategies. These tools enable risk managers to anticipate and prepare for potential threats.

- Data Mining and Exploration Tools: These tools help risk managers uncover hidden patterns and relationships within large datasets. This can reveal previously unknown risk factors. Tools like RapidMiner and KNIME offer powerful data mining capabilities.

- Risk Modeling Software: Some BI platforms offer specialized risk modeling features. These allow risk managers to simulate different scenarios and assess the impact of various risks on the organization. These tools enable a more sophisticated and nuanced approach to risk assessment.

Benefits of Using BI Tools for Risk Management

The integration of BI tools into a risk management framework offers a multitude of benefits. These benefits translate into a more resilient and successful organization:

- Improved Risk Identification: BI tools enable risk managers to identify potential risks earlier and more accurately. By analyzing vast amounts of data, they can spot emerging trends and anomalies that might otherwise go unnoticed.

- Enhanced Decision-Making: Data-driven insights empower risk managers to make more informed decisions. They can base their decisions on evidence rather than intuition. This results in more effective risk mitigation strategies.

- Increased Efficiency: BI tools automate many of the tasks associated with risk analysis and reporting. This frees up risk managers to focus on more strategic activities. They can dedicate more time to proactive risk management.

- Better Communication: Data visualizations and interactive dashboards make it easier to communicate risk-related information to stakeholders. This ensures that everyone is on the same page. This fosters a culture of risk awareness.

- Reduced Costs: By proactively identifying and mitigating risks, BI tools can help organizations avoid costly losses. They can prevent financial damage and protect the organization’s reputation.

Implementing BI Tools: A Step-by-Step Guide

Successfully implementing BI tools requires a strategic approach. Following these steps can help ensure a smooth transition:

- Define Objectives: Clearly define the goals of implementing BI tools. What specific risks are you trying to address? What key performance indicators (KPIs) will you track?

- Assess Data Sources: Identify all relevant data sources. This includes internal data (financial records, operational data) and external data (market trends, economic indicators).

- Choose the Right Tools: Select BI tools that meet your specific needs. Consider factors such as ease of use, scalability, and integration capabilities.

- Clean and Prepare Data: Ensure that your data is accurate, consistent, and properly formatted. Data quality is critical for accurate analysis.

- Develop Dashboards and Reports: Create dashboards and reports that provide actionable insights. Focus on the information that is most relevant to your objectives.

- Train Users: Provide training to risk managers and other stakeholders on how to use the BI tools. This ensures that everyone can effectively leverage the tools.

- Monitor and Refine: Continuously monitor the performance of the BI tools. Make adjustments as needed to improve their effectiveness.

Real-World Examples: BI Tools in Action

Many organizations are already using BI tools to enhance their risk management capabilities. Here are a few examples:

- Financial Institutions: Banks and other financial institutions use BI tools to detect fraud, assess credit risk, and monitor regulatory compliance. These tools help protect against financial losses and maintain customer trust.

- Healthcare Organizations: Hospitals and healthcare providers use BI tools to analyze patient data, identify potential safety risks, and improve operational efficiency. These tools help improve patient outcomes and reduce costs.

- Manufacturing Companies: Manufacturers use BI tools to monitor supply chain risks, identify potential production disruptions, and improve product quality. These tools help maintain operational continuity and protect profitability.

- Retail Businesses: Retailers use BI tools to analyze sales data, identify potential inventory shortages, and manage cybersecurity risks. These tools help optimize operations and protect customer data.

These examples demonstrate the versatility of BI tools across various industries. They can be adapted to address a wide range of risk management challenges.

The Future of Risk Management and BI Tools

The integration of BI tools into risk management is not just a trend; it is a fundamental shift. As the volume and complexity of data continue to grow, the need for sophisticated analytical tools will only increase. The future of risk management is inextricably linked to the advancement of BI tools. Risk managers who embrace these tools will be better positioned to navigate the uncertainties of the modern business environment. They will be better equipped to protect their organizations from potential threats and drive sustainable success. Investing in BI tools is an investment in the future of risk management.

Overcoming Challenges

While the benefits of BI tools are significant, there are also challenges to consider. Data quality can be a major hurdle. Inaccurate or incomplete data can lead to flawed insights. Organizations must invest in data governance and data cleansing processes. Another challenge is the need for skilled personnel. Risk managers need training in data analysis and BI tool usage. Organizations must invest in training and development. Finally, integrating BI tools with existing systems can be complex. Careful planning and execution are essential for a successful implementation.

Conclusion: Embracing the Power of BI

In conclusion, risk managers need BI tools to effectively manage risk in today’s dynamic business environment. These tools provide the power to analyze data, identify trends, and make informed decisions. By embracing BI tools, risk managers can improve their risk identification capabilities, enhance their decision-making processes, and ultimately, protect their organizations from potential threats. The future of risk management is data-driven, and BI tools are the key to unlocking the power of that data. Risk managers must adopt these tools to stay ahead of the curve. They can navigate the complexities of the modern world. They can build a more resilient and successful organization.

[See also: The Role of AI in Risk Management]

[See also: Data Analytics for Risk Professionals]

[See also: Cybersecurity Risk Management]

By understanding why risk managers need these BI tools, organizations can improve their risk management strategies. It is important to know the benefits of BI tools. The risk managers can make informed decisions. They can identify risk and protect the organization. The core of this article is about why risk managers need these BI tools. The risk managers can improve the efficiency. They can identify the risk. The risk managers can use these tools for better communication. They can reduce costs. Organizations should know why risk managers need these BI tools. The risk analysis is important for all organizations. The risk managers can mitigate the risk. The risk managers are using BI tools for the risk assessment. The risk managers should have a good understanding of the benefits. The risk management is very important.