Starting with the best insurance rates in NC, this paragraph aims to grab the reader’s attention and provide an enticing overview of the topic. Whether you’re looking for auto, home, health, or life insurance, understanding the key factors that influence rates in North Carolina is crucial. From how your location impacts premiums to the role of your credit score, we delve into everything you need to know to secure the best insurance rates in NC.

Factors Affecting Insurance Rates in North Carolina

Insurance rates in North Carolina are influenced by several key factors that insurers take into consideration when determining premiums.

Location

The location where you reside plays a significant role in insurance rates. Urban areas tend to have higher rates due to increased traffic congestion and higher likelihood of accidents, vandalism, and theft.

Driving Record

Your driving record is a crucial factor in determining insurance rates. Drivers with a history of accidents or traffic violations are considered higher risk and may face higher premiums.

Age, Best insurance rates in nc

Age is another factor that impacts insurance rates. Younger drivers, especially teenagers, typically have higher rates due to their limited driving experience and higher likelihood of accidents.

Coverage Options

The coverage options you choose also affect insurance rates. Opting for comprehensive coverage or adding additional riders will increase premiums, while choosing basic coverage may result in lower rates.

Credit Score

Your credit score can also influence insurance rates. Insurers often use credit-based insurance scores to assess risk. A higher credit score is associated with lower risk, leading to potentially lower premiums.

Types of Insurance Available in North Carolina

When it comes to insurance in North Carolina, there are several types of policies available to protect individuals and their assets. It is essential to understand the different options to choose the right coverage based on specific needs.

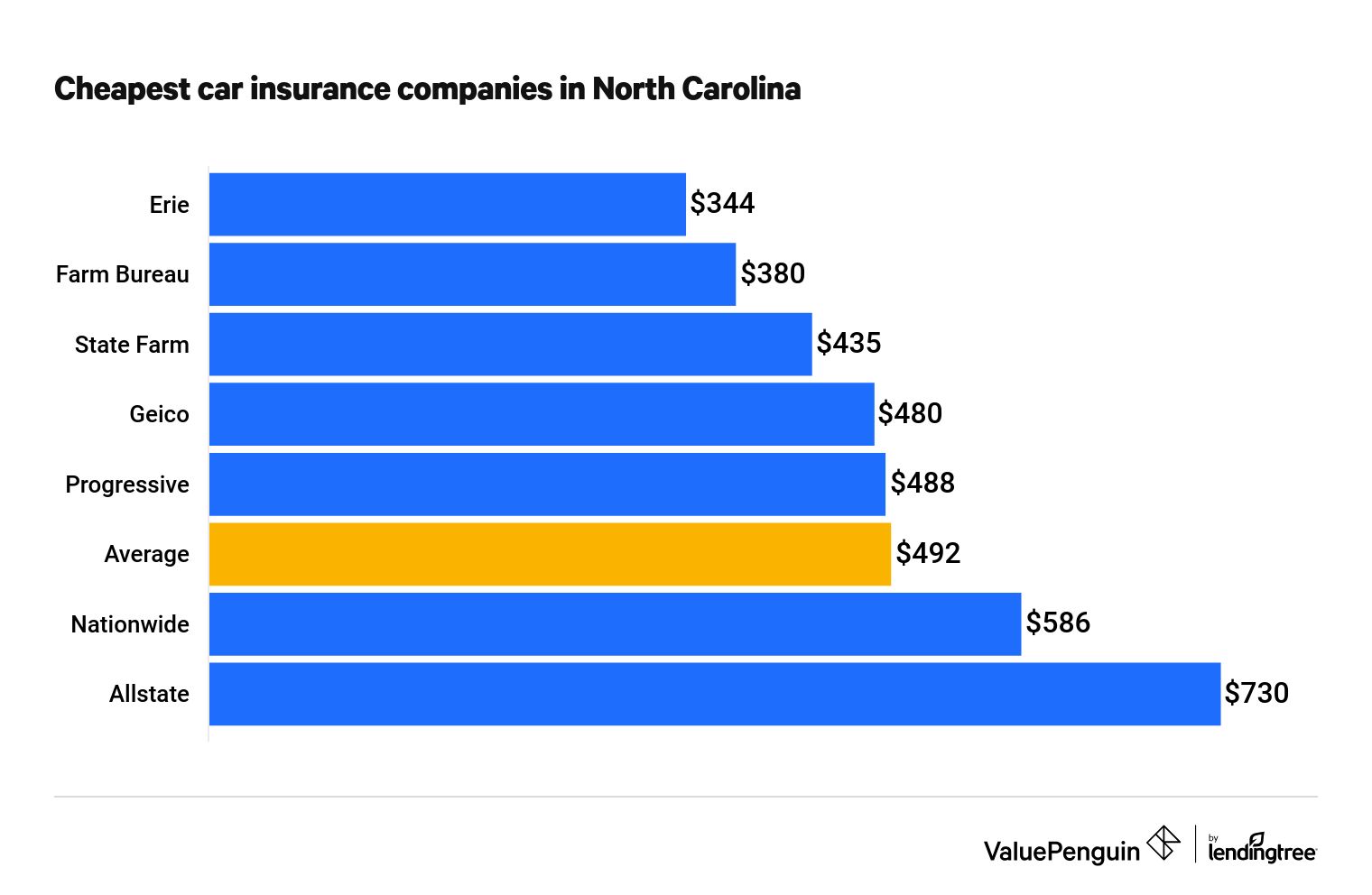

Auto Insurance

Auto insurance is mandatory in North Carolina and provides financial protection in case of accidents or theft. It covers damages to the vehicle and medical expenses resulting from accidents. Comparing quotes from different providers can help find the best rates.

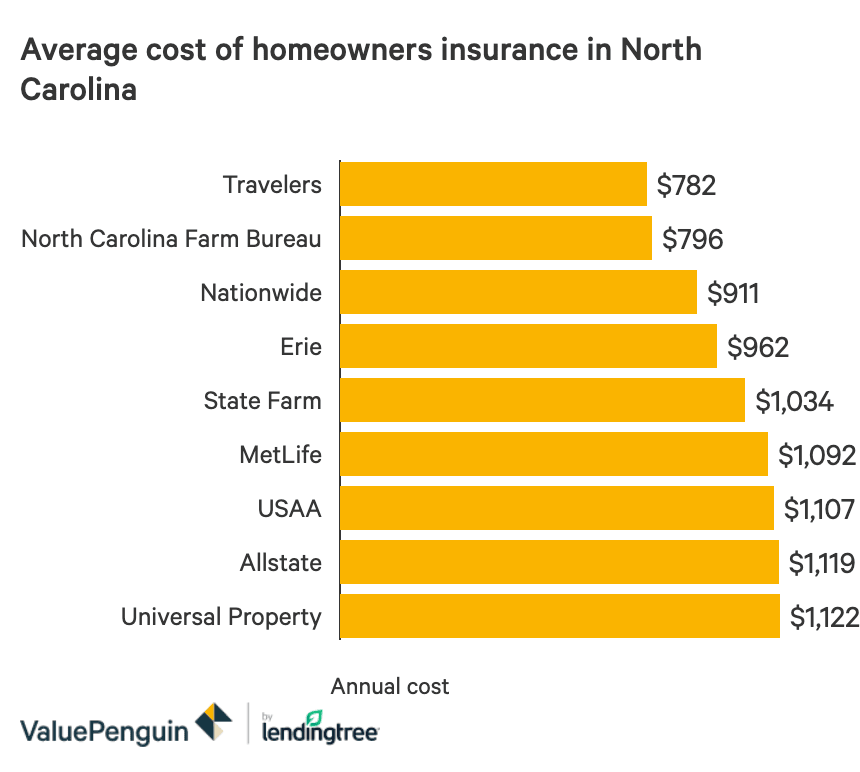

Home Insurance

Home insurance protects homeowners from financial losses due to damages to their property or belongings. It covers incidents such as fire, theft, or natural disasters. It is important to assess the value of the home and its contents to determine the appropriate coverage.

Health Insurance

Health insurance provides coverage for medical expenses, including doctor visits, prescriptions, and hospital stays. In North Carolina, individuals can choose from various health insurance plans offered by private insurers or through the Health Insurance Marketplace. Understanding the terms and coverage of each plan is crucial in selecting the right one.

Life Insurance

Life insurance offers financial protection to beneficiaries in case of the policyholder’s death. It can help cover funeral expenses, outstanding debts, or provide financial support to loved ones. There are different types of life insurance policies, such as term life or whole life, each with its own benefits and considerations.

Choosing the right type of insurance in North Carolina depends on individual needs, lifestyle, and financial situation. It is essential to assess risks, compare quotes, and understand the coverage options to make an informed decision that provides adequate protection.

Tips for Finding the Best Insurance Rates in North Carolina

When looking for the best insurance rates in North Carolina, it’s essential to compare rates from different providers to ensure you are getting the most competitive price for the coverage you need. By following these strategies, you can potentially save money on your insurance premiums.

Comparing Insurance Rates

- Obtain quotes from multiple insurance companies to compare prices for the same coverage.

- Consider factors such as deductibles, coverage limits, and exclusions when comparing rates.

- Use online comparison tools or work with an independent insurance agent to streamline the process.

Bundling Policies for Savings

- Bundle your home, auto, and other insurance policies with the same provider to potentially receive a discount.

- Insurance companies often offer discounts for bundling policies, which can result in significant savings.

- Review your current insurance policies to see if bundling is an option and inquire about potential discounts.

Shopping Around and Seeking Discounts

- Don’t settle for the first insurance quote you receive; shop around to explore different options.

- Ask insurance providers about available discounts for factors like good driving records, safety features, or multiple policies.

- Consider factors such as customer service, claims process, and financial stability when choosing an insurance provider.

Regulations and Laws Impacting Insurance Rates in North Carolina

Insurance rates in North Carolina are governed by specific laws and regulations set by the state. These regulations play a crucial role in determining the pricing and coverage options available to consumers.

State Regulations Influencing Pricing and Coverage Options

The North Carolina Department of Insurance regulates insurance rates in the state to ensure that they are fair and reasonable for policyholders. These regulations aim to protect consumers from unfair pricing practices and ensure that insurance companies operate within the law.

- Insurance companies in North Carolina are required to file their rates with the Department of Insurance for approval before they can be implemented. This helps prevent companies from charging excessive premiums.

- The state also has specific laws in place to govern factors that can be used to determine insurance rates, such as driving record, age, and location. This helps maintain consistency and fairness in pricing.

- Regulations also dictate the minimum coverage requirements for certain types of insurance, such as auto insurance, to ensure that all drivers have adequate protection.

Recent Changes in Legislation Impacting Insurance Rates

In recent years, there have been several changes in legislation that have impacted insurance rates in North Carolina. For example, the state has implemented new laws to address issues like distracted driving and insurance fraud, which can influence rates for auto insurance policies.

- Changes in healthcare laws at the federal level have also had an impact on health insurance rates in the state, leading to adjustments in pricing and coverage options.

- Additionally, advancements in technology and data analytics have allowed insurance companies to better assess risk factors, leading to more personalized pricing for policyholders.

Final Review: Best Insurance Rates In Nc

In conclusion, navigating the world of insurance rates in North Carolina can be complex, but armed with the right information, you can make informed decisions to find the best coverage at the most competitive prices. Remember to compare rates, consider bundling policies, and explore available discounts to maximize your savings while ensuring adequate protection for your needs.

Query Resolution

What factors most significantly impact insurance rates in NC?

Factors such as location, driving record, age, coverage options, and credit score play a crucial role in determining insurance premiums in North Carolina.

How can I find the best insurance rates in North Carolina?

To find the best insurance rates, compare quotes from different providers, consider bundling policies for discounts, and always look for available discounts to lower your premiums.

What are the common types of insurance available in North Carolina?

Common types of insurance in NC include auto, home, health, and life insurance. It’s essential to choose the right type based on your individual needs.