Business Intelligence Tools to Monitor Transactions: A Comprehensive Guide

In today’s fast-paced business environment, the ability to effectively monitor financial transactions is no longer a luxury, but a necessity. Businesses of all sizes are generating massive amounts of data daily. This data holds valuable insights into operational efficiency, customer behavior, and potential fraud. Leveraging business intelligence tools to monitor transactions enables organizations to gain a competitive edge. These tools allow them to make data-driven decisions and mitigate risks.

This comprehensive guide delves into the world of business intelligence tools to monitor transactions. It explores their benefits, key features, and implementation strategies. We’ll also examine some of the leading tools available in the market, helping you choose the right solution for your specific needs. The ultimate goal is to empower businesses with the knowledge and tools they need to optimize their financial operations. This will also improve overall performance.

The Critical Role of Transaction Monitoring

Transaction monitoring is the process of observing financial activities. It is a critical function for several reasons. Firstly, it helps businesses detect and prevent fraudulent activities. This includes unauthorized transactions, money laundering, and other financial crimes. Secondly, transaction monitoring provides valuable insights into customer behavior. It helps identify trends, patterns, and anomalies. Finally, it enables businesses to comply with regulatory requirements. These requirements are related to financial reporting and anti-money laundering (AML) regulations.

Without effective transaction monitoring, businesses face significant risks. These risks include financial losses, reputational damage, and legal penalties. Business intelligence tools to monitor transactions provide a robust solution. They streamline the monitoring process and enhance the ability to detect and respond to threats effectively.

Key Benefits of Using Business Intelligence Tools

Implementing business intelligence tools to monitor transactions offers a multitude of benefits. These benefits extend beyond simple fraud detection. They encompass a broader range of operational and strategic advantages:

- Enhanced Fraud Detection: These tools use advanced analytics and machine learning algorithms. They detect suspicious activities in real-time. This allows for immediate action.

- Improved Regulatory Compliance: Staying compliant with regulations is crucial. BI tools automate reporting and ensure adherence to AML and other financial regulations.

- Data-Driven Decision Making: These tools provide actionable insights into financial performance. This enables better decision-making based on data.

- Increased Efficiency: Automating transaction monitoring reduces manual processes. This saves time and resources.

- Reduced Operational Costs: By automating tasks, these tools minimize the need for manual data analysis. This leads to significant cost savings.

- Real-time Insights: Immediate access to transaction data helps businesses respond quickly to emerging risks.

Essential Features to Look for in Business Intelligence Tools

When selecting a business intelligence tool to monitor transactions, it’s essential to consider certain key features. These features are crucial for ensuring the tool effectively meets your needs:

- Real-time Monitoring and Alerts: The ability to monitor transactions in real-time is paramount. The tool should generate instant alerts for suspicious activities.

- Advanced Analytics: Look for tools that offer advanced analytics capabilities. These capabilities include predictive modeling, anomaly detection, and pattern recognition.

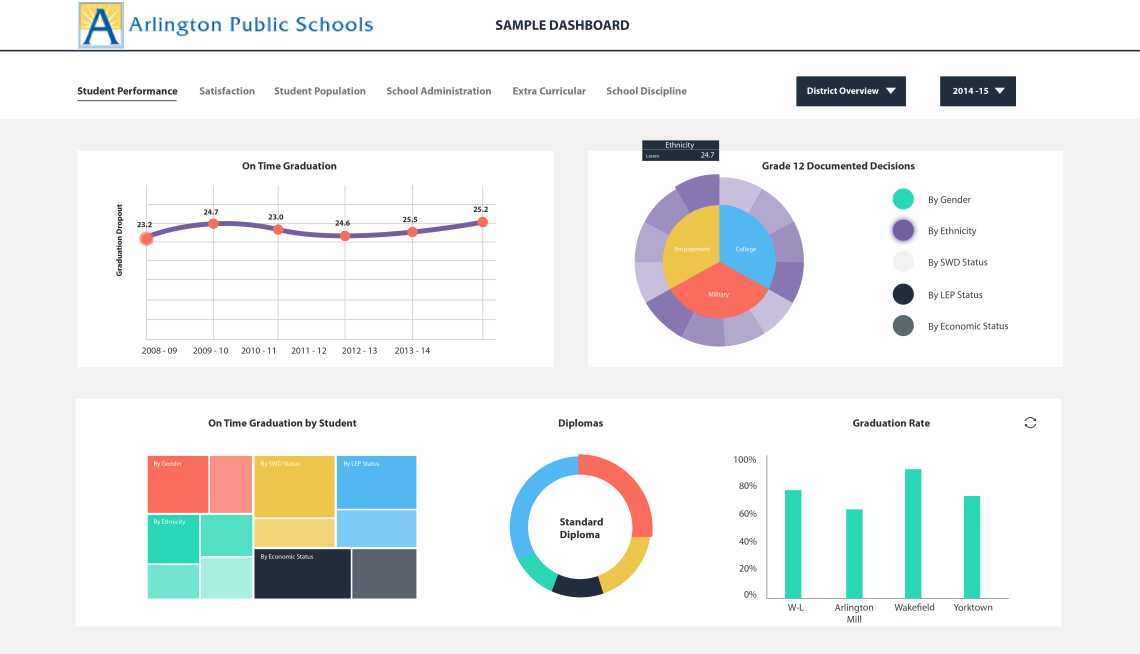

- Customizable Dashboards and Reporting: The tool should allow for customization of dashboards and reports. This ensures that you can view the data most relevant to your business.

- Integration Capabilities: Ensure the tool integrates seamlessly with your existing systems. This includes accounting software, CRM systems, and other relevant platforms.

- Scalability: As your business grows, your transaction volume will increase. Choose a tool that can scale to accommodate your future needs.

- User-Friendly Interface: The tool should have an intuitive and user-friendly interface. This will allow your team to easily navigate and use the system.

- Data Security and Compliance: Prioritize tools with robust security features and compliance certifications. This ensures the protection of sensitive financial data.

Top Business Intelligence Tools for Transaction Monitoring

Several business intelligence tools to monitor transactions stand out in the market. These tools offer a range of features and capabilities to meet diverse business needs:

- Tableau: Tableau is a leading data visualization and analytics platform. It allows users to create interactive dashboards and reports. This helps in analyzing transaction data effectively.

- Microsoft Power BI: Power BI is another powerful BI tool. It offers a wide range of data connectivity options and advanced analytics features. Power BI is suitable for businesses of all sizes.

- Qlik Sense: Qlik Sense is known for its associative data modeling capabilities. It helps users discover hidden insights in their data.

- Looker: Looker is a modern business intelligence platform. It offers data modeling and exploration features. It is suitable for complex data environments.

- Sisense: Sisense is a BI platform that excels in data integration and performance. It enables fast and efficient data analysis.

The best tool for your business will depend on your specific requirements. Consider factors such as data volume, technical expertise, and budget when making your decision. These tools have built-in capabilities to help you with business intelligence tools to monitor transactions.

Implementing Business Intelligence Tools: A Step-by-Step Guide

Implementing business intelligence tools to monitor transactions involves several key steps. Following a structured approach ensures a smooth and successful implementation:

- Define Your Objectives: Clearly define your goals for transaction monitoring. Identify the specific risks you want to address and the insights you want to gain.

- Assess Your Data Sources: Identify all the data sources relevant to transaction monitoring. This includes accounting systems, payment gateways, and other relevant platforms.

- Choose the Right Tool: Evaluate different BI tools based on your requirements. Consider factors such as features, scalability, and cost.

- Data Integration and Preparation: Integrate your data sources with the chosen BI tool. Clean and prepare the data for analysis.

- Configure Monitoring Rules and Alerts: Set up monitoring rules and alerts based on your risk profile. Define thresholds for suspicious activities.

- Create Dashboards and Reports: Design dashboards and reports to visualize your transaction data. This will enable you to track key metrics.

- Train Your Team: Provide training to your team on how to use the BI tool effectively. Ensure they understand the monitoring process.

- Monitor and Optimize: Continuously monitor your transaction data. Regularly review and optimize your monitoring rules and alerts.

Proper implementation is key to the success of your business intelligence tools to monitor transactions. Remember to monitor it regularly.

Best Practices for Effective Transaction Monitoring

To maximize the effectiveness of your business intelligence tools to monitor transactions, adhere to these best practices:

- Regularly Review and Update Rules: Financial landscapes and fraud techniques change. Regularly review and update your monitoring rules.

- Stay Informed About Emerging Threats: Keep up-to-date on the latest fraud trends and regulatory changes. This ensures your monitoring remains effective.

- Automate Where Possible: Automate as much of the monitoring process as possible. This will improve efficiency and accuracy.

- Establish Clear Reporting Procedures: Define clear reporting procedures. This enables swift action when suspicious activities are detected.

- Foster a Culture of Awareness: Educate your employees about fraud prevention and transaction monitoring. This promotes a proactive approach.

- Conduct Regular Audits: Regularly audit your transaction monitoring processes. This ensures they are effective and compliant.

Conclusion: Embracing Business Intelligence for Transaction Security

In conclusion, adopting business intelligence tools to monitor transactions is essential for modern businesses. These tools offer significant advantages in fraud detection, regulatory compliance, and data-driven decision-making. By choosing the right tool, implementing it effectively, and adhering to best practices, businesses can safeguard their financial operations and maintain a competitive edge. The right BI tools can help you with business intelligence tools to monitor transactions.

The future of transaction monitoring lies in the continued advancement of BI technologies. These technologies include machine learning and artificial intelligence. Businesses that embrace these advancements will be well-positioned to navigate the evolving landscape of financial risk. [See also: Related Article Titles]