Kicking off with can you cancel claim car insurance, this topic delves into the process of canceling a car insurance claim, reasons for cancellation, and the impact it can have. It aims to provide a clear and concise overview for readers seeking information on this subject.

Overview of canceling a car insurance claim

When it comes to car insurance claims, there may be instances where policyholders consider canceling their claim. This process involves withdrawing a claim that has been filed with the insurance company for damages or losses related to a vehicle. There are several reasons why someone might want to cancel a car insurance claim, and it’s essential to understand the implications of such actions.

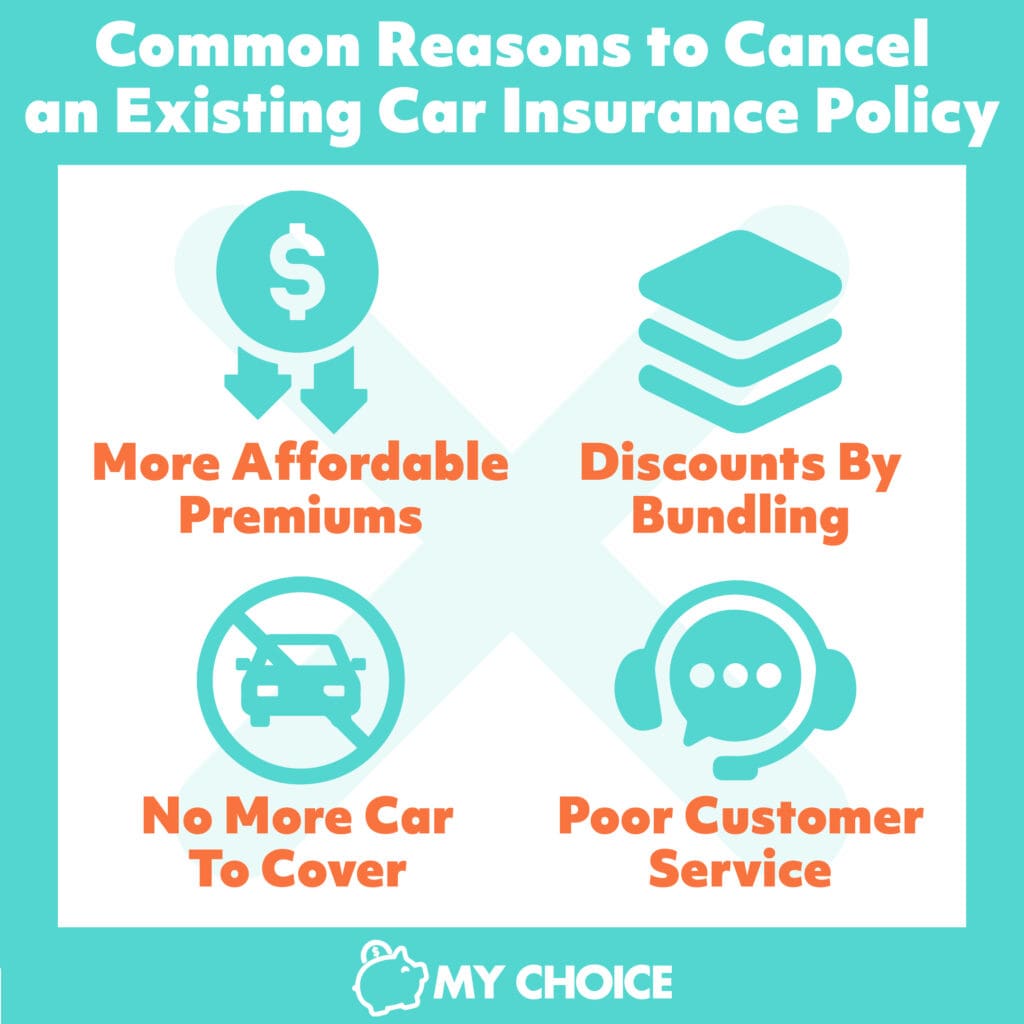

Reasons for canceling a car insurance claim

- Discovery of minimal damages: Sometimes, after filing a claim, the policyholder may realize that the damages are minor and can be easily repaired out of pocket. In such cases, canceling the claim can help avoid potential rate hikes in the future.

- Concerns about deductible: If the cost of repairs is close to or lower than the deductible amount, policyholders may choose to cancel the claim to avoid paying out of pocket for minor damages.

- Desire to maintain a claim-free record: Canceling a claim can help policyholders maintain a clean claims history, which can be beneficial when seeking lower premiums in the future.

Consequences of canceling a car insurance claim

- Impact on future rates: Canceling a claim may not necessarily prevent an increase in premiums, as insurance companies may still consider the incident when calculating rates in the future.

- Lack of coverage: If a claim is canceled, the policyholder may not receive any reimbursement for the damages or losses incurred, leaving them solely responsible for the expenses.

- Potential for denial of future claims: Some insurance companies may view frequent claim cancellations as a red flag, potentially leading to the denial of future claims or even policy cancellation.

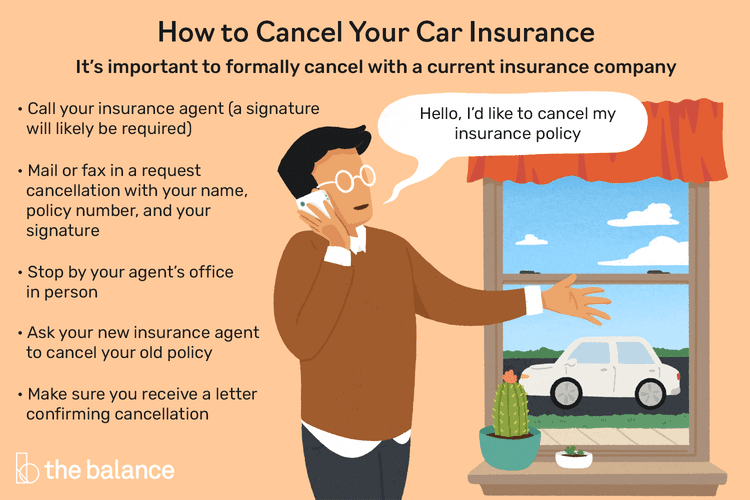

Steps to cancel a car insurance claim

When it comes to canceling a car insurance claim, there are specific steps you need to follow to ensure a smooth process and effective communication with the insurance company.

Gather necessary information

Before reaching out to your insurance company to cancel a claim, make sure you have all the necessary information on hand. This includes your policy number, details of the claim you wish to cancel, and any relevant documentation.

Contact your insurance company

Reach out to your insurance company either by phone or through their online portal to initiate the cancellation process. Be prepared to provide details about the claim and explain your reasons for wanting to cancel it.

Follow the company’s instructions

Listen carefully to the instructions provided by the insurance company on how to proceed with canceling the claim. They may require you to fill out a form, provide additional documentation, or follow specific steps to complete the cancellation process.

Communicate effectively, Can you cancel claim car insurance

When communicating with your insurance company, be clear and concise about your intentions to cancel the claim. Provide all the necessary information they require promptly to expedite the process and avoid any misunderstandings.

Confirm cancellation

After following the necessary steps and providing the required information, make sure to confirm with your insurance company that the claim has been successfully canceled. This will help prevent any future issues related to the claim.

Alternatives to canceling a car insurance claim

When considering canceling a car insurance claim, it’s important to explore alternatives that may better suit your situation. One alternative to canceling a claim is amending the claim instead. This option allows you to make changes to the original claim without completely canceling it.

Amending a car insurance claim

If you realize that certain details in your claim were incorrect or if new information has come to light, amending the claim may be a more suitable option. By amending the claim, you can update the necessary information and ensure that your claim accurately reflects the situation.

- Amending a claim can help prevent delays in the claims process, as you won’t have to start a new claim from scratch.

- It allows you to provide the insurance company with accurate and up-to-date information, increasing the likelihood of a successful claim.

- Amending a claim can also help avoid potential complications or disputes that may arise from canceling the claim altogether.

Impact of canceling a car insurance claim: Can You Cancel Claim Car Insurance

Canceling a car insurance claim can have various implications on an individual’s insurance coverage, premiums, and overall insurance history. Let’s delve into how this decision can affect your future dealings with your insurance provider.

Affect on future premiums

- Canceling a car insurance claim may lead to an increase in future premiums. Insurance companies typically consider claim history when determining premium rates, and canceling a claim could indicate a higher risk profile to the insurer.

- Insurance companies might view individuals who frequently cancel claims as more likely to file claims in the future, resulting in higher premiums to offset potential losses.

Repercussions on coverage or policy renewal

- Canceling a car insurance claim could affect your coverage options in the future. Insurance companies may be less inclined to offer comprehensive coverage or additional benefits if they perceive you as a higher risk due to canceled claims.

- Policy renewal terms and conditions may also be impacted by a history of canceled claims. Insurers may impose stricter conditions or higher premiums upon renewal if they see a pattern of canceled claims.

Impact on insurance history

- Canceling a car insurance claim becomes a part of your insurance history and could influence how other insurers view your risk profile in the future. It is essential to consider the long-term implications of canceling a claim on your insurance record.

- Repeated cancellations of claims could tarnish your insurance history, making it challenging to secure favorable terms and rates from insurers in the future. It is crucial to weigh the short-term benefits against the potential long-term consequences of canceling a claim.

Ending Remarks

In conclusion, understanding the process of canceling a car insurance claim is crucial to making informed decisions about your coverage. By exploring the options available and considering the implications, you can navigate this aspect of insurance management effectively.

FAQ Corner

Can I cancel a car insurance claim once it’s been filed?

Yes, it is possible to cancel a car insurance claim after it has been filed, but the process and implications may vary depending on the insurance company.

What are some reasons to cancel a car insurance claim?

Reasons for canceling a car insurance claim may include finding an alternative solution, realizing the claim was unnecessary, or wanting to avoid premium increases.

How does canceling a car insurance claim affect future premiums?

Canceling a car insurance claim may not directly impact future premiums, but it could affect your claims history and potentially influence rates in the long run.

Are there alternatives to canceling a car insurance claim?

Yes, alternatives to canceling a car insurance claim include amending the claim, settling the issue without filing, or exploring other options provided by the insurance company.

What documentation is needed to cancel a car insurance claim?

The documentation required to cancel a car insurance claim may vary, but generally, you will need to contact your insurance company and follow their specific procedures for cancellation.