Do you have to be a AAA member for insurance sets the stage for this informative exploration, shedding light on the advantages, process, and cost comparisons involved in obtaining insurance through AAA. This topic delves into the intricacies of AAA membership and its impact on insurance coverage, offering readers a comprehensive understanding of the subject matter.

As we delve deeper, we will uncover key details about AAA membership requirements, potential savings, and customer experiences, providing a well-rounded view of the insurance services offered by AAA.

Explaining AAA Membership for Insurance

Being a AAA member for insurance comes with a range of benefits that can provide peace of mind and savings for members.

Benefits of AAA Membership for Insurance

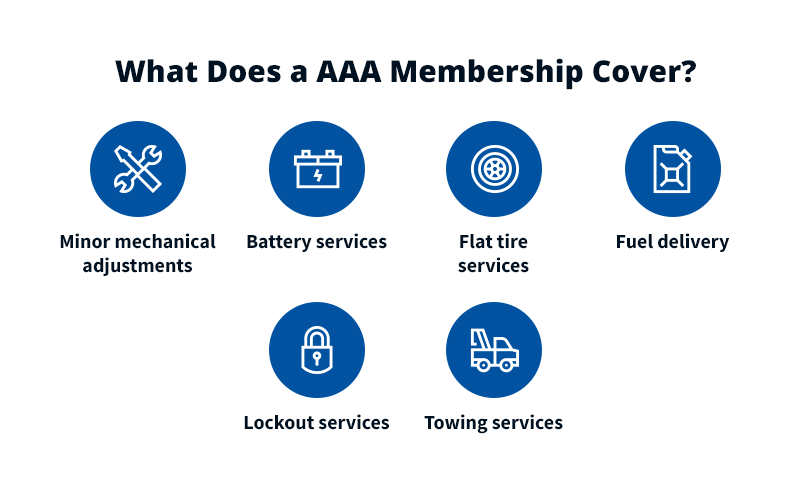

- 24/7 roadside assistance for covered vehicles, ensuring help is just a phone call away in case of emergencies.

- Exclusive discounts on auto insurance policies for AAA members, potentially saving money on premiums.

- Access to a network of trusted repair shops and service providers recommended by AAA, ensuring quality service for repairs and maintenance.

- Personalized customer service from AAA agents who understand the unique needs of members and can provide tailored insurance solutions.

Services Provided by AAA to Its Insurance Members, Do you have to be a aaa member for insurance

- Auto insurance coverage options tailored to meet the specific needs of members, including liability, comprehensive, and collision coverage.

- Home insurance policies to protect members’ homes and belongings from unexpected events like theft, fire, or natural disasters.

- Rental property insurance for members who own rental properties, providing coverage for the structure and liability protection.

Discounts and Special Offers for AAA Members

- Multi-policy discounts for members who bundle their auto and home insurance policies with AAA, saving on overall insurance costs.

- Safe driver discounts for members who have a clean driving record, rewarding responsible behavior on the road.

- Loyalty discounts for long-term AAA members who continue to renew their insurance policies with the organization.

Requirements for Non-AAA Members to Obtain Insurance

To obtain insurance through AAA as a non-member, individuals need to follow a specific process set by AAA to ensure eligibility for coverage. While AAA membership offers benefits and discounts, non-members can still access insurance options through AAA with some limitations and considerations.

Process for Non-AAA Members to Get Insurance

Non-AAA members interested in obtaining insurance through AAA can typically contact their local AAA branch or visit the official AAA website to explore available insurance options. They will need to provide personal information such as their name, address, contact details, and relevant details about the type of insurance coverage they are seeking. AAA representatives will guide non-members through the application process, which may involve additional steps compared to AAA members.

Limitations or Restrictions for Non-Members

Non-AAA members may face certain limitations or restrictions when obtaining insurance through AAA. These could include higher premium rates, fewer policy options, or limited access to certain benefits reserved for AAA members. Additionally, non-members may not be eligible for certain discounts or special offers that AAA members enjoy.

Alternatives for Insurance Coverage for Non-AAA Members

For non-AAA members seeking insurance coverage, there are alternative options available outside of AAA. They can explore insurance providers in the market, compare quotes, and choose a policy that best suits their needs and budget. Additionally, non-members can consider joining other membership organizations or affinity groups that offer insurance benefits to their members. It’s essential for non-AAA members to research and compare different insurance options to find the most suitable coverage for their individual circumstances.

Cost Comparison: Do You Have To Be A Aaa Member For Insurance

When it comes to insurance, one of the most important factors to consider is the cost. In this section, we will compare the insurance rates offered to AAA members versus non-members and analyze the value proposition of becoming a AAA member for insurance purposes.

AAA vs. Non-AAA Insurance Rates

- AAA members often enjoy discounted insurance rates compared to non-members. This is because AAA has partnerships with various insurance providers, allowing them to offer competitive rates to their members.

- Non-AAA members may have to pay higher premiums for the same coverage compared to AAA members. This is due to the group discounts and special rates negotiated by AAA on behalf of their members.

Potential Savings for AAA Members

- By being a AAA member, individuals can potentially save a significant amount of money on their insurance premiums. The savings can vary depending on the type of coverage and the insurance provider, but AAA members generally enjoy lower rates across the board.

- AAA members may also benefit from additional perks and discounts that are exclusive to members, further enhancing the value of their membership in terms of insurance savings.

Customer Experiences with AAA Insurance

AAA Insurance has garnered a reputation for providing reliable coverage and excellent customer service. Many AAA members have shared positive testimonials regarding their experiences with AAA Insurance.

Unique Features of AAA Insurance

- 24/7 Roadside Assistance: AAA Insurance offers round-the-clock roadside assistance to its policyholders, providing peace of mind in case of emergencies.

- Multi-Policy Discounts: Customers who bundle their insurance policies with AAA may be eligible for significant discounts, saving money on their premiums.

- Local Agents: AAA Insurance provides personalized service through local agents who are available to assist with claims and questions.

Common Complaints or Issues

- Claims Processing Delays: Some customers have reported delays in the claims processing and reimbursement process, leading to frustration.

- Premium Increases: Like many insurance providers, AAA Insurance may raise premiums over time, causing dissatisfaction among policyholders.

Epilogue

In conclusion, exploring the question of whether you need to be a AAA member for insurance reveals a nuanced landscape of benefits, costs, and customer feedback. By understanding the intricacies of AAA membership in relation to insurance coverage, individuals can make informed decisions about their insurance needs.

Top FAQs

Do I have to be a AAA member to get insurance through AAA?

Yes, AAA insurance is exclusively available to AAA members.

Are there any alternatives for non-AAA members to get insurance coverage?

Non-AAA members can explore other insurance providers for coverage.

What are the key differences in insurance rates between AAA members and non-members?

AAA members often enjoy discounted insurance rates compared to non-members.

Can non-AAA members access the same level of services as AAA members?

Non-AAA members may have limitations in accessing certain services provided to AAA members.