Delving into does USAA bundle insurance, this introduction immerses readers in a unique and compelling narrative. USAA offers insurance bundling services, providing cost-effective options with various types of insurance policies. Let’s explore the benefits, coverage options, eligibility criteria, and more in this detailed discussion.

Overview of USAA Insurance Bundling

Insurance bundling is the practice of combining multiple insurance policies, such as auto, home, and life insurance, with a single insurance provider. This allows customers to streamline their insurance coverage and potentially save on premiums.

USAA offers insurance bundling services to its members, allowing them to bundle auto, home, renters, and other insurance policies together. By consolidating their insurance needs with USAA, customers can benefit from convenience, potential cost savings, and the ease of managing all their policies in one place.

Benefits of Bundling with USAA

- Discounts: USAA offers discounts to customers who bundle multiple insurance policies, helping them save on their overall premiums.

- Convenience: By having all insurance policies with one provider, customers can enjoy the convenience of managing their coverage in one place.

- Customized Coverage: USAA helps customers tailor their insurance coverage to meet their individual needs, ensuring they have the right protection for their assets.

- Personalized Service: USAA is known for its exceptional customer service, providing support and guidance to customers throughout the insurance process.

Types of Insurance Offered by USAA: Does Usaa Bundle Insurance

USAA offers a wide range of insurance products to meet the diverse needs of its members. By bundling different types of insurance policies, customers can not only simplify their coverage but also potentially save money on premiums. Let’s explore the various types of insurance policies available through USAA and how bundling can be a cost-effective option.

Auto Insurance

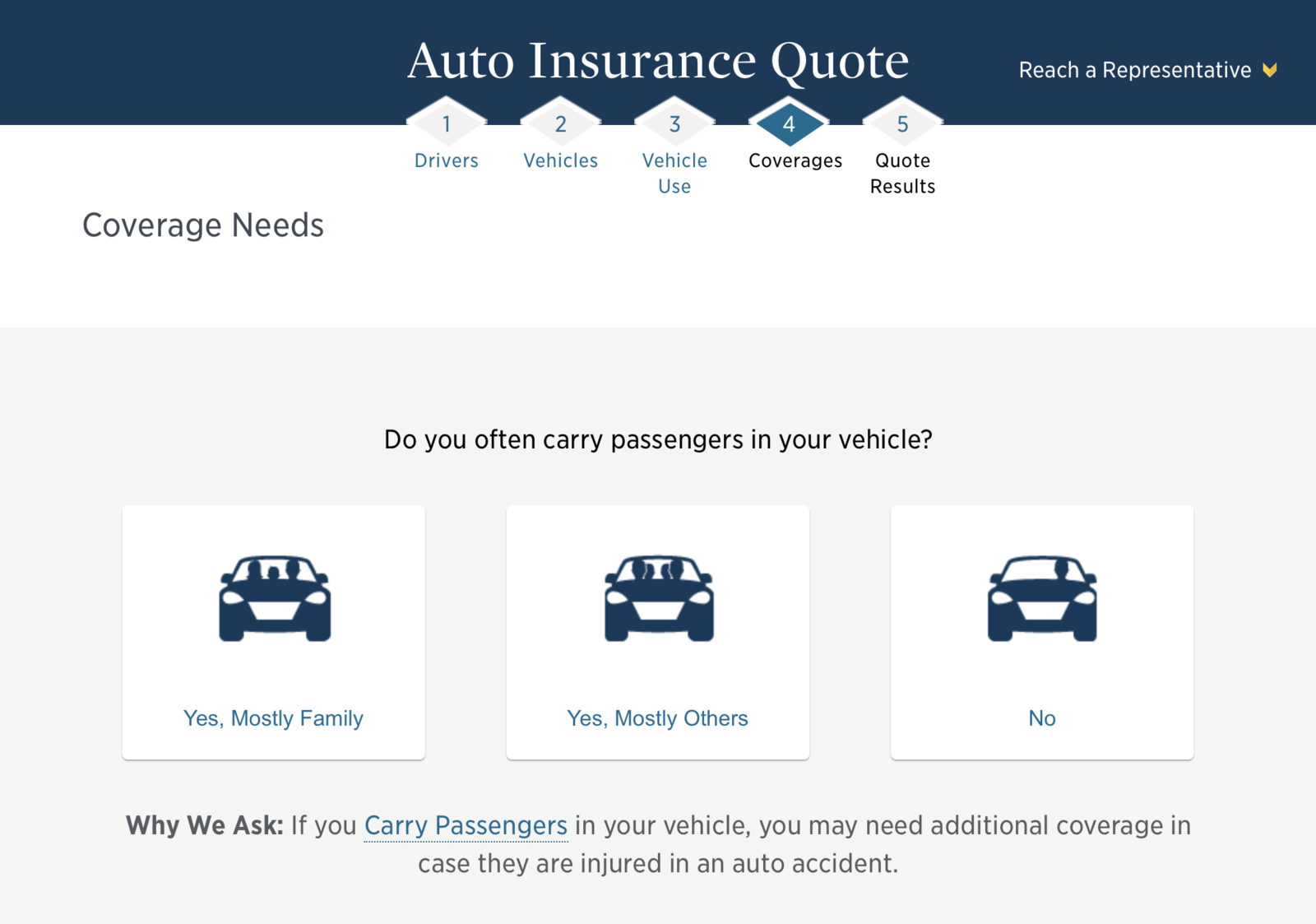

USAA provides auto insurance coverage for cars, motorcycles, and other vehicles. Members can customize their policies to include liability, collision, comprehensive, uninsured/underinsured motorist, and personal injury protection.

Homeowners Insurance, Does usaa bundle insurance

Homeowners insurance from USAA protects your home and personal belongings from damage or loss due to covered perils like fire, theft, vandalism, and natural disasters. Additional coverage options include liability protection and reimbursement for temporary living expenses.

Renters Insurance

For those who rent their homes, USAA offers renters insurance to safeguard personal belongings and provide liability coverage. This policy can also cover additional living expenses if your rental becomes uninhabitable due to a covered event.

Life Insurance

USAA offers various life insurance options, including term life, whole life, and universal life policies. Life insurance provides financial protection for your loved ones in the event of your passing, helping cover expenses like mortgage payments, debts, and future financial needs.

Bundle and Save

When you bundle two or more insurance policies with USAA, you may qualify for a multi-policy discount. By combining auto, homeowners, renters, or life insurance, you could enjoy significant savings on your overall premiums compared to purchasing each policy separately.

Pricing Comparison

Individual insurance policies may have higher premiums when purchased alone, as opposed to bundled policies that offer discounts. Bundling can provide cost savings while also simplifying the insurance process by consolidating multiple policies under one provider.

Coverage Options in USAA Bundle

When it comes to coverage options in a USAA bundle, there are several common types of insurance that are typically included to provide comprehensive protection for members. These bundles are designed to offer convenience and savings by combining multiple insurance policies into one package.

Auto Insurance Coverage

- Liability Coverage: Protects you financially if you are responsible for causing injuries or property damage in an accident.

- Collision Coverage: Covers the cost of repairing or replacing your vehicle if it is damaged in a collision.

- Comprehensive Coverage: Helps pay for damage to your car that is not caused by a collision, such as theft, vandalism, or natural disasters.

Home Insurance Coverage

- Dwelling Coverage: Covers the structure of your home in case of damage from covered perils like fire, windstorm, or theft.

- Personal Property Coverage: Protects your belongings inside the home, such as furniture, electronics, and clothing.

- Liability Coverage: Offers financial protection if someone is injured on your property and decides to sue.

Life Insurance Coverage

- Term Life Insurance: Provides coverage for a specific period, usually 10, 20, or 30 years.

- Whole Life Insurance: Offers coverage for your entire life and includes a cash value component.

- Universal Life Insurance: Combines a death benefit with an investment component that can accumulate cash value over time.

Additional Perks and Features

USAA bundle insurance plans may also include perks and features such as:

Multi-policy Discount: Save money by bundling multiple insurance policies together.

24/7 Claims Service: Access to round-the-clock claims assistance for added convenience.

Roadside Assistance: Help with services like towing, jump-starts, and flat tire changes in case of car trouble.

Eligibility and Requirements for Bundling with USAA

When it comes to bundling insurance policies with USAA, there are certain eligibility criteria and requirements that customers need to meet in order to take advantage of this option.

In order to be eligible for bundling insurance with USAA, customers typically need to meet the following criteria:

Eligibility Criteria for Bundling with USAA

- Must be a member of USAA: To bundle insurance policies with USAA, individuals must first be a member of the organization. USAA membership is typically available to current and former military members and their families.

- Must have multiple insurance policies: In order to bundle, customers must have multiple insurance policies, such as auto and homeowners insurance, that they wish to combine under USAA.

Requirements for Bundling with USAA

- Policy Compatibility: Not all insurance policies can be bundled together, so customers must ensure that the policies they wish to combine are eligible for bundling.

- Underwriting Guidelines: Customers must meet USAA’s underwriting guidelines for each type of insurance being bundled in order to qualify for the bundled discount.

Impact on Discounts and Premiums

- Discounts: Bundling insurance policies with USAA can often lead to discounts on premiums. The more policies a customer bundles, the higher the potential discount may be.

- Premiums: Bundling can also result in lower overall premiums compared to purchasing separate policies from different providers. This can lead to cost savings for customers in the long run.

Last Recap

In conclusion, USAA’s insurance bundling services offer a convenient and efficient way to protect your assets. With tailored coverage options and potential discounts, bundling with USAA can be a smart choice for members.

FAQ Insights

What types of insurance policies can I bundle with USAA?

You can bundle various types of insurance policies with USAA, including auto, home, and renters insurance for potential cost savings.

Are there customization options available for bundled coverage with USAA?

Yes, USAA offers customization options for tailored coverage to meet your specific needs and preferences.

How does bundling insurance with USAA affect discounts and premiums?

Bundling insurance with USAA may make you eligible for discounts and lower premiums, providing added value for members.