How BI Tools Help You Reduce Fraud: A Data-Driven Approach

In an increasingly complex world, fraud continues to evolve. Businesses of all sizes face persistent threats. These threats come from various sources. They range from internal actors to sophisticated external schemes. Combating fraud requires a proactive and data-driven approach. Business Intelligence (BI) tools are essential in this fight. They offer powerful capabilities to identify and mitigate fraudulent activities. This article explores how BI tools help you reduce fraud. We will look at their key features, benefits, and real-world applications.

Understanding the Fraud Landscape

Fraud is a costly problem. It impacts businesses financially and reputationally. The Association of Certified Fraud Examiners (ACFE) estimates that organizations lose 5% of their revenue to fraud each year. This underscores the need for robust fraud detection and prevention strategies. Fraud can manifest in various forms. These include financial statement fraud, asset misappropriation, and corruption. Each type requires a specific approach to detection and prevention. The rise of digital transactions and online commerce has created new opportunities for fraudsters. This makes the task of fraud prevention even more challenging.

The Role of Business Intelligence (BI) Tools

BI tools are software applications designed to analyze data. They transform raw data into actionable insights. These tools enable businesses to understand trends, patterns, and anomalies. This understanding is crucial for fraud detection. BI tools offer several key features that are beneficial in fraud prevention:

- Data Integration: BI tools can connect to various data sources. These sources include databases, spreadsheets, and cloud applications. This allows for a unified view of all relevant data.

- Data Visualization: BI tools provide powerful data visualization capabilities. They create dashboards and reports. These allow users to easily identify suspicious activities.

- Data Analysis: Advanced analytical capabilities are available. These include statistical analysis and predictive modeling. They help identify fraudulent patterns and predict future fraud risks.

- Alerting and Reporting: BI tools can generate alerts. These alerts are triggered by predefined rules or anomalies. They also provide comprehensive reporting features. These features support investigation and prevention efforts.

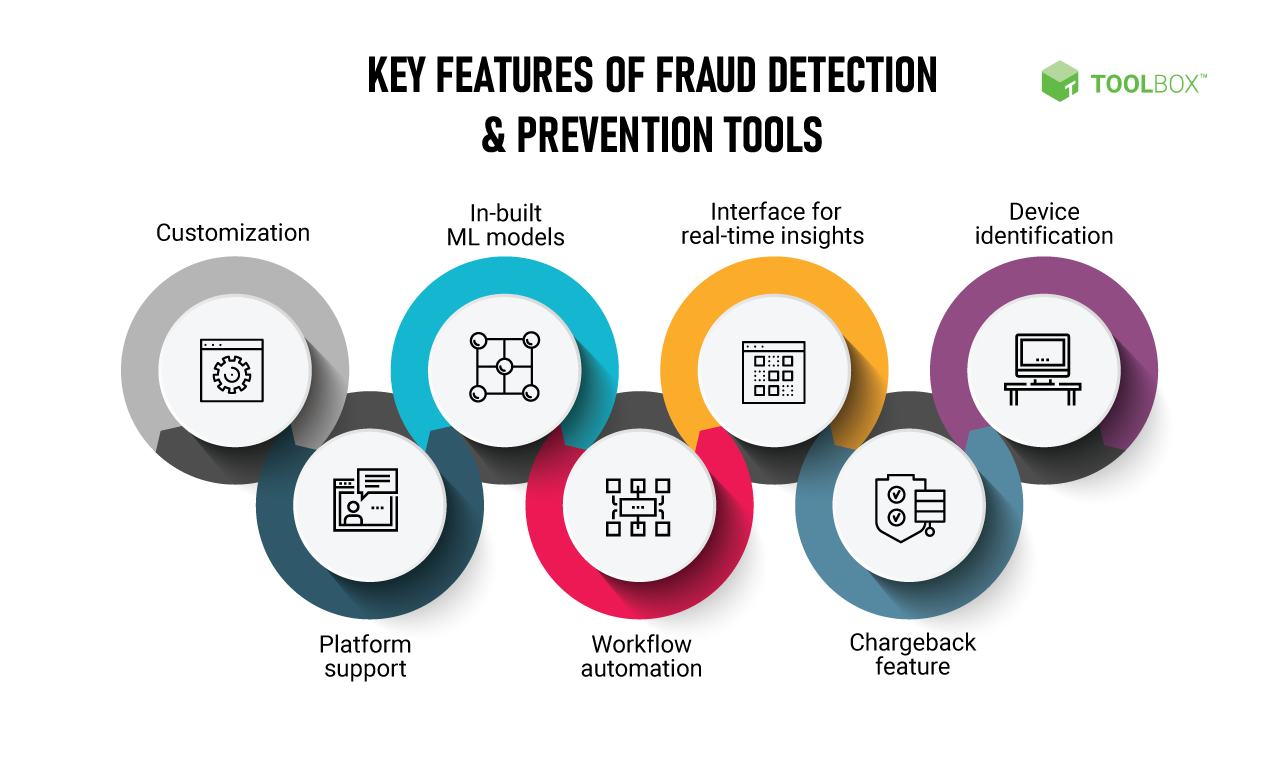

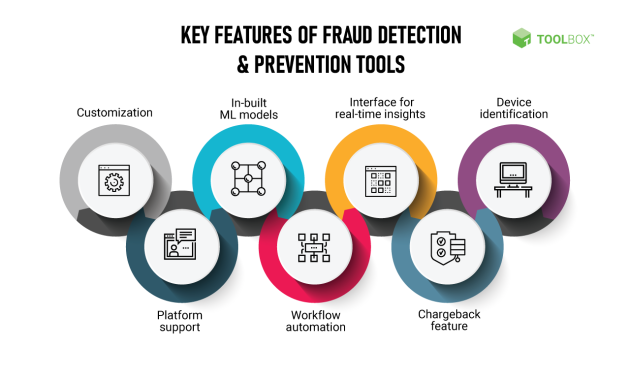

Key Features of BI Tools for Fraud Detection

Several specific features of BI tools are particularly useful in fraud detection. These features enable businesses to proactively identify and prevent fraudulent activities:

Anomaly Detection

BI tools excel at identifying anomalies. These are unusual data points or patterns. This helps detect suspicious transactions or activities. Algorithms are used to establish normal behavior baselines. Deviations from these baselines trigger alerts. This allows for quick investigation. For example, a sudden surge in transactions from a particular location can be flagged as suspicious. This is especially true if it deviates from the normal spending patterns.

Pattern Recognition

BI tools can identify patterns of fraudulent behavior. By analyzing historical data, these tools uncover common tactics used by fraudsters. This helps businesses proactively identify and prevent fraud. For instance, patterns might include unusual transaction sequences. They might also include transactions involving specific vendors or individuals. The ability to recognize these patterns is crucial.

Real-Time Monitoring

Real-time monitoring is a critical aspect of fraud detection. BI tools can monitor transactions and activities as they occur. This enables businesses to detect and respond to fraud quickly. Real-time monitoring is especially important in industries. These industries include finance and e-commerce. They often experience high transaction volumes. This helps in flagging suspicious activity before significant losses occur.

Data Visualization and Dashboards

Data visualization is key to understanding complex data. BI tools offer dashboards and reports. These highlight key metrics and trends. They allow users to quickly identify potential fraud. Visualizations can show transaction volumes. They can also show spending patterns. These are easily understood at a glance. This helps in quick decision-making.

Benefits of Using BI Tools for Fraud Reduction

Implementing BI tools offers several significant benefits. These benefits help businesses reduce fraud and protect their assets.

Improved Fraud Detection Accuracy

BI tools significantly improve the accuracy of fraud detection. They use advanced analytics and real-time monitoring. This leads to fewer false positives. This also leads to fewer missed fraudulent activities. This helps organizations to focus their resources effectively. They can prioritize investigations and prevention efforts. This ultimately leads to better fraud detection rates.

Reduced Financial Losses

By detecting fraud early, BI tools help reduce financial losses. Early detection allows businesses to quickly intervene. This prevents further fraudulent transactions. This helps recover assets. It minimizes the overall financial impact of fraud. This translates into significant cost savings for the business. It also protects the organization’s bottom line.

Enhanced Compliance

BI tools assist businesses in meeting regulatory requirements. They provide audit trails and reporting capabilities. This helps with compliance with anti-fraud regulations. This reduces the risk of penalties. It also protects the organization’s reputation. This is especially important in highly regulated industries. These industries include finance and healthcare.

Increased Operational Efficiency

BI tools streamline fraud detection processes. They automate data analysis and reporting. This frees up valuable time for fraud investigators. They can focus on more complex investigations. This leads to increased operational efficiency. It also allows businesses to allocate resources more effectively.

Real-World Applications of BI Tools in Fraud Prevention

BI tools are used across various industries. These tools provide effective fraud prevention strategies. Here are some real-world examples:

Financial Services

Banks and financial institutions use BI tools to detect fraudulent transactions. They monitor customer accounts. They also monitor payment card activity. This helps them identify suspicious patterns. They flag unusual transactions. They can also prevent unauthorized access to accounts. This is crucial for protecting customer funds.

E-commerce

E-commerce businesses use BI tools to combat online fraud. They analyze customer behavior. They also analyze transaction patterns. This helps identify and prevent fraudulent orders. They can also detect account takeovers. This protects against chargebacks. It also protects against losses due to fraudulent activities.

Healthcare

Healthcare organizations use BI tools to detect healthcare fraud. They analyze claims data. They identify billing irregularities. They also detect fraudulent practices. This helps prevent financial losses. It also helps protect patient data. This ensures compliance with healthcare regulations.

Insurance

Insurance companies use BI tools to identify fraudulent claims. They analyze claims data. They identify suspicious patterns. They also detect inflated claims. This helps prevent financial losses. It also ensures fair payouts to legitimate claimants.

Implementing BI Tools for Fraud Reduction: Best Practices

Implementing BI tools effectively is critical. This ensures the best results in fraud reduction. Here are some best practices:

Define Clear Objectives

Start by defining clear goals. Determine what types of fraud you want to detect and prevent. Identify specific metrics to measure success. This helps in selecting the right BI tools. It also helps in setting up the system effectively.

Choose the Right BI Tool

Select a BI tool that meets your specific needs. Consider factors like data integration capabilities. Also consider data visualization features. You should also consider analytical capabilities. Choose a tool that is scalable. Choose one that is easy to use. This will ensure the best results.

Integrate Data from Multiple Sources

Integrate data from all relevant sources. This includes financial systems, customer databases, and transaction logs. This ensures a comprehensive view of all the data. It helps identify patterns and anomalies across multiple data points.

Develop Fraud Detection Rules and Alerts

Create rules and alerts. These will trigger when suspicious activities are detected. These rules should be based on industry best practices. They should also be based on your organization’s specific risk profile. This helps in proactive fraud detection.

Provide Ongoing Training

Train your employees on how to use the BI tools. This training helps them understand the data. It helps them interpret the results. They can also respond to alerts effectively. Ongoing training ensures that everyone is up-to-date. They will also be able to use the tools effectively.

Regularly Review and Update the System

Regularly review the fraud detection system. This helps ensure its effectiveness. Update the system with new data. Also update it with the latest fraud tactics. This proactive approach ensures that the system remains relevant. It also remains effective in preventing fraud. This helps to protect the organization.

The Future of Fraud Detection with BI Tools

The fight against fraud is ongoing. BI tools will continue to evolve. This evolution will stay ahead of emerging threats. Here are some trends.

Artificial Intelligence and Machine Learning

AI and machine learning will play an increasingly important role. These will enhance fraud detection capabilities. They will automate data analysis. They will also improve the accuracy of predictions. This will make fraud detection more proactive.

Advanced Data Analytics

Advanced analytics will become more sophisticated. This will enable the identification of complex fraud schemes. This will help uncover hidden patterns. This will ultimately improve fraud prevention.

Cloud-Based Solutions

Cloud-based BI tools will become more prevalent. They offer scalability. They also offer accessibility. They reduce the need for on-premise infrastructure. This makes them more cost-effective and easier to implement.

Conclusion

How BI tools help you reduce fraud is clear. They are essential for effective fraud detection and prevention. By leveraging the power of data analysis, visualization, and real-time monitoring, businesses can protect their assets. They can also safeguard their reputations. Implementing BI tools is an investment. This investment pays off through reduced financial losses. It also pays off through enhanced compliance. As fraud continues to evolve, adopting a data-driven approach is critical. It helps businesses stay ahead of the curve. It ensures a secure and sustainable future. This helps organizations of all sizes. It will also help them to thrive in a complex business environment. [See also: Related Article Titles]