Insurance options for small business owners set the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. In this guide, we will explore different types of insurance options, important factors to consider, budgeting strategies, legal requirements, and compliance issues faced by small business owners.

Types of Insurance Options

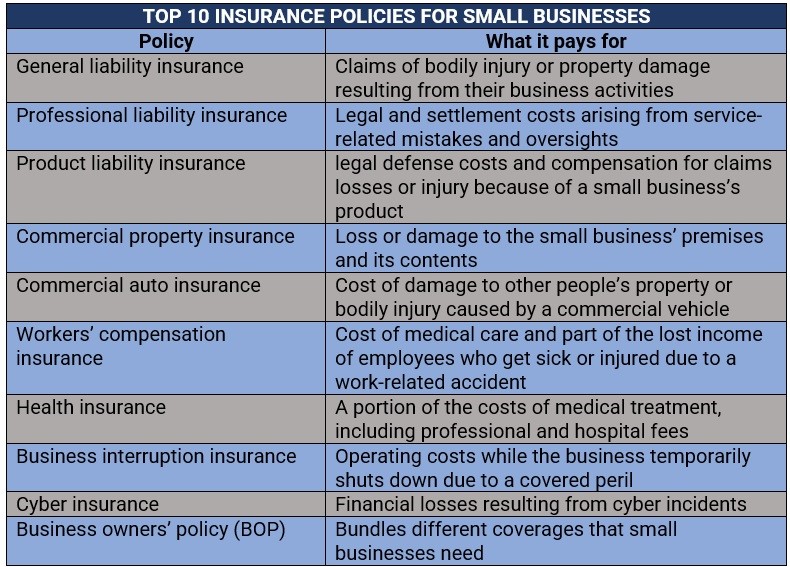

Insurance is crucial for small business owners to protect their assets and mitigate risks. There are several types of insurance options available, each providing unique coverage tailored to different aspects of a business. Let’s explore the key features and benefits of three common types of insurance: general liability insurance, professional liability insurance, and commercial property insurance.

General Liability Insurance

General liability insurance is essential for small business owners as it provides coverage for third-party bodily injury, property damage, and advertising injury claims. This type of insurance protects businesses from lawsuits and helps cover legal expenses, medical costs, and settlements. General liability insurance is often required by landlords, clients, or vendors before entering into contracts with a business.

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, is designed to protect businesses that provide professional services or advice. This type of insurance covers claims of negligence, errors, or omissions that result in financial loss for clients. Professional liability insurance is crucial for small business owners in industries such as consulting, legal services, healthcare, and technology, where mistakes can lead to costly lawsuits.

Commercial Property Insurance

Commercial property insurance is essential for small business owners who own or lease a physical space for their operations. This type of insurance provides coverage for the building, equipment, inventory, and other assets in case of theft, fire, vandalism, or natural disasters. Commercial property insurance helps businesses recover from property damage and replace lost or damaged assets, ensuring continuity of operations.

Factors to Consider: Insurance Options For Small Business Owners

When choosing insurance options for their small businesses, owners need to carefully consider several factors to ensure adequate coverage and protection. It is essential to assess the specific needs of the business and the potential risks it may face in order to make informed decisions regarding insurance coverage.

Risks Associated with Inadequate Insurance

Inadequate insurance coverage can expose small business owners to significant financial risks and liabilities. Without proper insurance protection, businesses may face challenges in covering unexpected expenses, legal claims, property damage, or loss of income. This can lead to financial instability and even the closure of the business.

Unique Insurance Needs by Industry

Different industries have unique insurance needs based on the nature of their operations, the types of products or services they offer, and the specific risks they face. For example, a construction company may require liability insurance to protect against accidents on job sites, while a healthcare practice may need malpractice insurance to cover professional errors. Understanding the specific insurance requirements of their industry can help small business owners choose the right coverage options to mitigate risks effectively.

Cost and Budgeting

Starting and running a small business comes with various expenses, and insurance costs can be a significant part of the budget. It is essential for small business owners to effectively budget for insurance costs to ensure they have adequate coverage without overspending.

Effective Budgeting Strategies

- Assess Your Needs: Evaluate the specific risks and liabilities of your business to determine the types and amount of insurance coverage required.

- Compare Quotes: Obtain multiple quotes from different insurance providers to find the best coverage at competitive rates.

- Consider Bundling: Some insurance companies offer discounts for bundling multiple policies, such as combining general liability and property insurance.

Reducing Insurance Costs, Insurance options for small business owners

- Implement Risk Management Practices: Minimize risks in your business operations to potentially reduce insurance premiums.

- Review Coverage Regularly: Periodically review your insurance policies to ensure you are not paying for coverage you no longer need.

- Increase Deductibles: Opting for higher deductibles can lower your insurance premiums, but make sure you can afford the out-of-pocket expenses if a claim arises.

Negotiating Premiums with Providers

- Highlight Your Business’s Track Record: Emphasize your business’s safety measures, claims history, and financial stability to negotiate lower premiums.

- Ask About Discounts: Inquire about available discounts, such as for safety features, industry affiliations, or paying premiums annually instead of monthly.

- Seek Professional Help: Consider working with an insurance broker who can negotiate on your behalf and provide insights into the insurance market.

Legal Requirements and Compliance

When it comes to running a small business, understanding the legal requirements and compliance related to insurance coverage is crucial. By ensuring that your business meets the necessary insurance regulations, you can protect your company from potential legal issues that may arise in the future.

Insurance Requirements for Small Businesses

Small businesses are often required to have certain types of insurance coverage in place to comply with legal regulations. These requirements can vary depending on the location and industry of the business. For example, a construction company may need to have liability insurance to protect against accidents on the job site, while a retail store may need property insurance to cover damage to inventory.

It’s important for small business owners to research and understand the specific insurance requirements that apply to their industry and location. Failure to comply with these regulations can result in fines, penalties, or even the closure of the business.

Examples of Insurance Requirements

- Workers’ Compensation Insurance: Many states require businesses with employees to have workers’ compensation insurance to cover medical expenses and lost wages in case of work-related injuries.

- Professional Liability Insurance: Certain professions, such as doctors, lawyers, and architects, may be required to have professional liability insurance to protect against claims of negligence or malpractice.

- Commercial Auto Insurance: Businesses that use vehicles for work purposes may need commercial auto insurance to cover accidents or damages involving company vehicles.

Closure

In conclusion, navigating through the realm of insurance options for small business owners requires careful consideration and strategic planning. By understanding the various types of insurance, factors to consider, budgeting techniques, and legal requirements, small business owners can protect their ventures effectively. Stay informed and proactive to ensure the long-term success of your business.

Clarifying Questions

Is business interruption insurance necessary for small business owners?

Yes, business interruption insurance can provide crucial financial support in case of unexpected disruptions to your operations, such as natural disasters or equipment breakdowns.

What factors determine the cost of insurance for small businesses?

The cost of insurance is influenced by factors like the type of coverage needed, the size of your business, industry risks, location, and claims history.

Are there specific insurance requirements for home-based businesses?

Home-based businesses may require additional insurance coverage like a business owner’s policy (BOP) to protect against liabilities that may not be covered by homeowners insurance.

Can small business owners negotiate insurance premiums with providers?

Yes, small business owners can often negotiate insurance premiums by comparing quotes from different providers, bundling policies, or demonstrating a strong risk management strategy.