The Best Business Intelligence Tools for Banking: A Comprehensive Guide

In today’s rapidly evolving financial landscape, banks and financial institutions are under immense pressure to make data-driven decisions. The ability to analyze vast amounts of data, identify trends, and gain actionable insights is no longer a luxury but a necessity. This is where Business Intelligence (BI) tools come into play. These tools empower banking professionals to transform raw data into meaningful information, leading to improved performance, enhanced customer experiences, and a competitive edge. This article delves into the best business intelligence tools for banking, providing a comprehensive overview of their features, benefits, and considerations for implementation. The focus keyword, “The Best Business Intelligence Tools for Banking”, will be woven throughout this guide.

Understanding the Role of Business Intelligence in Banking

Before exploring the specific tools, it’s crucial to understand the fundamental role of business intelligence in the banking sector. BI tools enable banks to:

- Improve Decision-Making: By providing real-time data and analytical capabilities, BI tools facilitate informed decision-making across various departments, from risk management to marketing.

- Enhance Customer Experience: Understanding customer behavior and preferences through data analysis allows banks to personalize services and improve customer satisfaction.

- Optimize Operational Efficiency: BI tools help identify areas for process improvement, streamline operations, and reduce costs.

- Mitigate Risks: By analyzing financial data and identifying potential risks, BI tools assist in fraud detection, compliance, and regulatory reporting.

- Gain a Competitive Advantage: Data-driven insights enable banks to understand market trends, identify new opportunities, and stay ahead of the competition.

Key Features of Effective Business Intelligence Tools for Banking

The best business intelligence tools for banking share several key features that make them effective for the financial sector:

- Data Integration: The ability to integrate data from various sources, including core banking systems, CRM platforms, and external data feeds, is essential.

- Data Visualization: Powerful visualization tools, such as dashboards and interactive reports, help users understand complex data at a glance.

- Advanced Analytics: Capabilities for performing advanced analytics, including predictive modeling, machine learning, and data mining, are crucial for gaining deeper insights.

- Security and Compliance: Robust security features and compliance with industry regulations, such as GDPR and CCPA, are paramount.

- Scalability: The ability to scale the tool to accommodate growing data volumes and user needs is important.

- User-Friendly Interface: Intuitive interfaces and ease of use are essential for enabling banking professionals to analyze data without requiring extensive technical expertise.

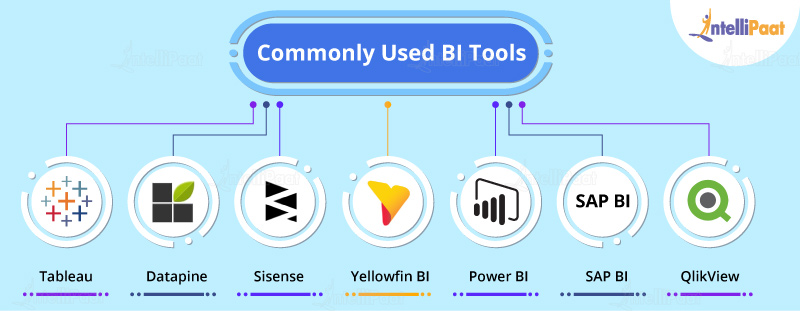

Top Business Intelligence Tools for Banking

Several BI tools are particularly well-suited for the banking industry. Here are some of the best business intelligence tools for banking:

Tableau

Tableau is a leading data visualization and analytics platform known for its user-friendly interface and powerful capabilities. It allows banks to create interactive dashboards, reports, and visualizations to gain insights from their data. Tableau’s drag-and-drop interface makes it easy for users to explore data and create custom visualizations. It offers strong data integration capabilities, connecting to a wide range of data sources. Tableau is a strong contender among the best business intelligence tools for banking.

Microsoft Power BI

Microsoft Power BI is another popular BI tool that provides a comprehensive suite of features for data analysis and visualization. It integrates seamlessly with other Microsoft products, making it a natural choice for organizations already using the Microsoft ecosystem. Power BI offers a wide range of data connectors, advanced analytics capabilities, and interactive dashboards. It is a cost-effective option, making it accessible to a wide range of banks. Microsoft Power BI is considered one of the best business intelligence tools for banking.

Qlik Sense

Qlik Sense is a data analytics platform known for its associative data model, which allows users to explore data in new and intuitive ways. It offers powerful data discovery and visualization capabilities, making it easy for users to uncover hidden insights. Qlik Sense also provides advanced analytics features, including predictive modeling and machine learning. It is a good choice for banks looking for a flexible and user-friendly BI solution. Qlik Sense is another one of the best business intelligence tools for banking.

Sisense

Sisense is a BI platform focused on providing a complete end-to-end solution for data analytics. It offers a wide range of features, including data integration, data modeling, data visualization, and advanced analytics. Sisense is known for its ability to handle large data volumes and its focus on ease of use. It is a good choice for banks looking for a comprehensive and scalable BI solution. Sisense definitely ranks as one of the best business intelligence tools for banking.

Oracle Analytics Cloud

Oracle Analytics Cloud (OAC) is a cloud-based BI platform that offers a wide range of features for data analysis and visualization. It integrates seamlessly with other Oracle products, making it a natural choice for organizations already using the Oracle ecosystem. OAC offers a wide range of data connectors, advanced analytics capabilities, and interactive dashboards. It is a scalable and secure option, making it suitable for large banks. Oracle Analytics Cloud is among the best business intelligence tools for banking.

Implementing Business Intelligence Tools in Banking: Key Considerations

Implementing business intelligence tools in banking requires careful planning and execution. Here are some key considerations:

- Define Objectives: Clearly define the business goals and objectives that the BI tool will help achieve.

- Assess Data Sources: Identify and assess the data sources that will be used by the BI tool.

- Choose the Right Tool: Select the BI tool that best meets the bank’s specific needs and requirements.

- Data Integration and Preparation: Integrate data from various sources and prepare the data for analysis.

- User Training: Provide training to users on how to use the BI tool effectively.

- Security and Governance: Implement robust security measures and data governance policies.

- Ongoing Monitoring and Optimization: Continuously monitor the performance of the BI tool and optimize its usage.

The Benefits of Using Business Intelligence Tools in Banking

The benefits of using business intelligence tools in banking are numerous and far-reaching. Banks that successfully implement BI tools can:

- Improve Profitability: By identifying opportunities for revenue growth and cost reduction.

- Reduce Risk: By identifying and mitigating potential risks.

- Enhance Customer Loyalty: By providing personalized services and improving customer experiences.

- Increase Efficiency: By streamlining operations and automating tasks.

- Make Better Decisions: By providing data-driven insights and supporting informed decision-making.

Conclusion: The Future of Business Intelligence in Banking

The best business intelligence tools for banking are essential for success in the modern financial landscape. Banks that embrace these tools and leverage their data to gain insights will be well-positioned to thrive in a competitive market. As technology continues to evolve, the role of BI in banking will only become more critical. Banks must continuously evaluate and adapt their BI strategies to stay ahead of the curve. Choosing the right tool is critical. The best business intelligence tools for banking will continue to be instrumental in shaping the future of the financial services industry.

[See also: Related Article Titles]