Unveiling the Power: Business Intelligence Tools for Claims Analysis

In the fast-paced world of insurance, healthcare, and other industries dealing with claims, the ability to swiftly analyze and understand data is paramount. This is where business intelligence tools for claims analysis step in, transforming raw data into actionable insights. These tools are no longer a luxury, but a necessity, enabling organizations to make data-driven decisions, mitigate risks, and optimize operations. This article delves into the critical role of business intelligence tools for claims analysis, exploring their benefits, features, and impact on the claims process. We will examine how these tools empower businesses to navigate the complexities of claims management, leading to improved efficiency and profitability.

The Evolution of Claims Analysis

Historically, claims analysis was a manual, time-consuming process. Analysts sifted through mountains of paperwork, spreadsheets, and disparate databases. This approach was prone to errors, delays, and a lack of comprehensive understanding. The advent of business intelligence tools for claims analysis marked a significant shift. These tools automated data collection, integration, and analysis, providing a more holistic and efficient approach. They enabled organizations to move from reactive to proactive claims management, identifying trends and potential issues before they escalated.

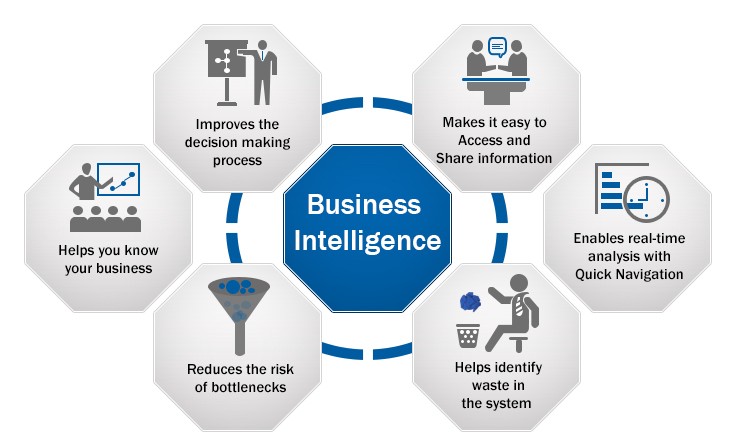

Core Benefits of Business Intelligence Tools

The advantages of utilizing business intelligence tools for claims analysis are numerous and far-reaching. These tools offer several key benefits that drive organizational success. Here are some crucial benefits:

- Enhanced Decision-Making: BI tools provide real-time insights, enabling informed decisions based on factual data.

- Improved Efficiency: Automation of data analysis streamlines processes, reducing manual effort and saving time.

- Fraud Detection and Prevention: Advanced analytics identify suspicious patterns, helping prevent fraudulent claims.

- Cost Reduction: By optimizing claims processing and identifying inefficiencies, BI tools lead to significant cost savings.

- Risk Mitigation: Early identification of emerging risks allows for proactive measures to minimize potential losses.

- Improved Customer Satisfaction: Faster claims processing and accurate assessments enhance the customer experience.

Key Features of Effective Business Intelligence Tools

Not all business intelligence tools for claims analysis are created equal. Several core features are essential for optimal performance. Consider these features when evaluating and implementing a BI solution:

- Data Integration: The ability to seamlessly integrate data from various sources, including claims systems, policy databases, and external data feeds.

- Data Visualization: Interactive dashboards and reports that present complex data in an easily understandable format.

- Advanced Analytics: Capabilities like predictive modeling, statistical analysis, and pattern recognition to uncover hidden insights.

- Reporting and Alerting: Automated report generation and real-time alerts to notify users of critical events or anomalies.

- User-Friendly Interface: An intuitive interface that allows users of varying technical skill levels to access and analyze data.

- Scalability: The ability to handle increasing data volumes and adapt to evolving business needs.

How Business Intelligence Tools Transform Claims Analysis

Business intelligence tools for claims analysis revolutionize the claims process across several key areas:

Fraud Detection

Fraudulent claims are a major concern for many industries. BI tools employ advanced analytics to identify suspicious patterns and anomalies that may indicate fraudulent activity. By analyzing data such as claim amounts, provider information, and claimant history, these tools can flag potentially fraudulent claims for further investigation. This proactive approach helps to minimize financial losses and protect the integrity of the claims process.

Claims Processing Efficiency

BI tools streamline claims processing by automating data entry, validation, and routing. This reduces manual errors, speeds up processing times, and improves overall efficiency. Real-time dashboards provide claims adjusters with instant access to key information, enabling them to make faster and more informed decisions. As a result, claims are processed more quickly, leading to improved customer satisfaction and reduced operational costs.

Risk Management

Business intelligence tools for claims analysis enable organizations to proactively manage risk. By analyzing historical claims data, these tools can identify trends and patterns that indicate potential risks. For example, they can pinpoint areas with a high frequency of claims or identify specific types of claims that are particularly costly. This information allows organizations to implement targeted risk mitigation strategies, such as adjusting pricing, modifying policy terms, or implementing preventative measures. [See also: Risk Management Strategies in Insurance]

Cost Optimization

By providing insights into claims costs, BI tools help organizations optimize their spending. They can identify areas where costs are excessive, such as overpayments or unnecessary medical procedures. By analyzing data on provider costs, treatment patterns, and claim outcomes, organizations can negotiate better rates, improve resource allocation, and reduce overall claims expenses. This leads to significant cost savings and improved profitability. The use of business intelligence tools for claims analysis directly impacts the bottom line.

Examples of Business Intelligence Tools

Several business intelligence tools for claims analysis are available on the market, each offering unique features and capabilities. Here are some notable examples:

- Tableau: A popular data visualization tool that allows users to create interactive dashboards and reports.

- Power BI: Microsoft’s powerful BI platform, offering a wide range of data analysis and reporting features.

- Qlik Sense: A self-service BI platform with a focus on data discovery and exploration.

- SAS Visual Analytics: A comprehensive analytics platform that provides advanced data analysis and reporting capabilities.

- Looker: A modern business intelligence platform focused on data exploration and governance.

Implementing Business Intelligence Tools: A Practical Guide

Implementing business intelligence tools for claims analysis requires careful planning and execution. Here’s a step-by-step guide to help you get started:

- Define Objectives: Clearly identify the goals you want to achieve with the BI tools.

- Assess Data: Evaluate the quality and availability of your data sources.

- Choose the Right Tool: Select a BI tool that meets your specific needs and budget.

- Data Integration: Integrate data from various sources into the BI platform.

- Develop Dashboards and Reports: Create customized dashboards and reports to visualize your data.

- Train Users: Provide training to ensure users can effectively utilize the tools.

- Monitor and Optimize: Continuously monitor the performance of the BI tools and make adjustments as needed.

The Future of Claims Analysis and Business Intelligence

The future of claims analysis is inextricably linked to advancements in business intelligence tools for claims analysis. Emerging technologies such as artificial intelligence (AI) and machine learning (ML) are poised to further transform the industry. AI-powered tools can automate complex tasks, such as claims adjudication and fraud detection, while ML algorithms can identify hidden patterns and predict future trends. The integration of these technologies will enable organizations to make even more informed decisions, improve efficiency, and enhance the customer experience. [See also: AI in Insurance: Current Trends and Future Prospects]

Business intelligence tools for claims analysis are no longer optional; they are essential for success in today’s competitive market. By leveraging the power of data, organizations can gain a deeper understanding of their claims processes, mitigate risks, and achieve significant cost savings. The ability to analyze data effectively is crucial for success. Embracing these tools is a strategic move for any organization aiming to thrive in the claims landscape. As the industry evolves, the adoption and optimization of business intelligence tools for claims analysis will be crucial for maintaining a competitive edge.